US PPI Shows Inflation Upswing Well Under Way

What happened?

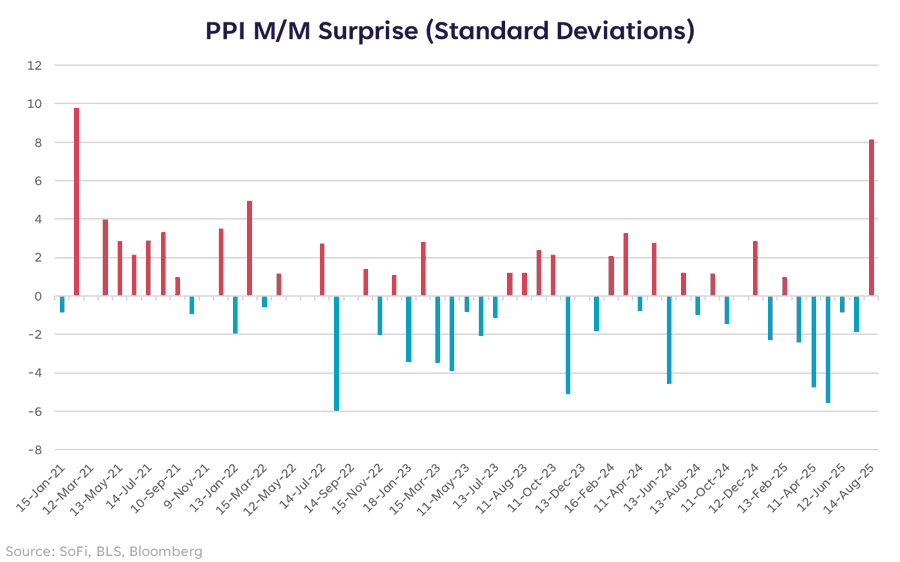

U.S. producer prices shocked to the upside yesterday: headline PPI rose 0.9% m/m , a 8-sigma surprise vs. expectations. The surge was broad, as services rose +1.1% m/m, goods +0.7% m/m, and the “core” gauge that strips out food, energy, and trade services jumped 0.6% m/m, its biggest rise since 2022. Tariff-sensitive categories (metals like steel/aluminum and other import-heavy durables) led notable price appreciation, while trade margins leapt 2.0%, signaling wholesalers are beginning to pass on tariff costs.

Why does this matter?

Tariff Pass-Through Arrives: A 0.9% monthly print (~11% annualised) with outsized gains in metal and import-exposed goods suggests tariff costs are now being pushed along the supply chain rather than absorbed. The key question will be whether the consumer accepts these.

Fed Cut Odds Trimmed: The upside surprise reduces appetite for aggressive easing. Markets have largely taken a 50bp September cut off the table and pared back overall cut odds.

What's the counterpoint?

PPI can be jumpy and this report had big one-offs: fresh/dry vegetables +38.9% m/m and a 2.0% spike in trade margins did a lot of lifting. If margins normalise and food volatility fades, the July burst could prove transitory—especially with consumer inflation still cooler.

finformant view

With a material US inflation upturn now clearly under way, the rate cut debate faces serious headwinds and the market may be dissappointed in its currently max dovish expectations. In particular long term bonds seems poised to sell off as long until the Fed starts talking hawkish again.