Tariff Price Shock Coming

What happened?

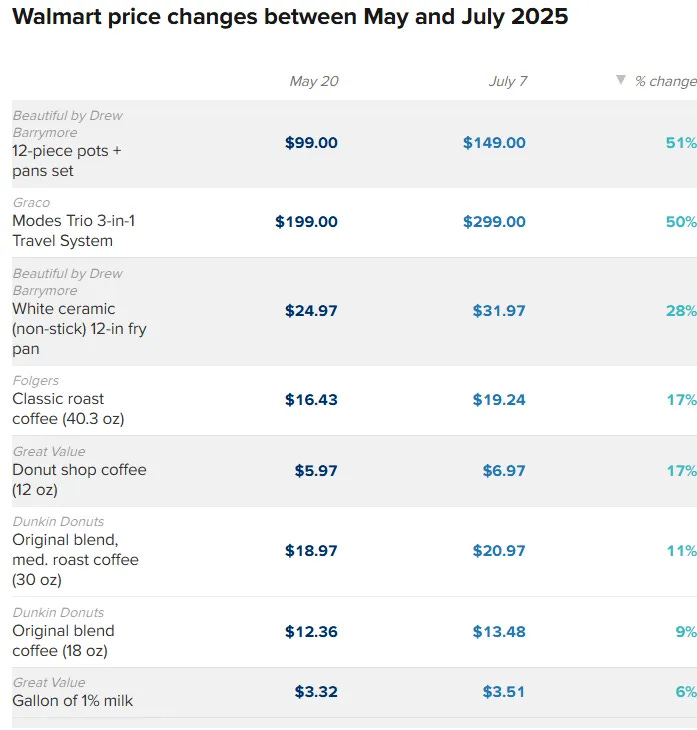

Over the past weeks, Walmart put through considerable price increases on many everyday items. This is likely only the beginning of a broader wave of prices hikes, as the retailer's pre-tariff inventory gradually runs low. With Walmart holding a signalling function within the retail space, its competitors will likely follow suit, essentially creating an inflation wave in the goods economy space that may cause a severe challenge to the US economy.

Source: CNBC

Why does this matter?

Fragile Economy: The US economy has been slowing all year. A negative supply shock owed caused by retailer price hikes could tip it into recession.

Fed's Hand Tied: Unless the price increases in the goods economy are overcompensated by price declines in services, inflation readings will likely move up considerably. This would make it very hard to the Fed to cut rates to cushion the blow.

What's the counterpoint?

While tariffs are now hitting the US economy more forcefully, there are also several growth-positive dynamics at work. Enhanced capex deductibility within the "Big Beautiful Bill" boosts cash flows for investment-heavy corporates such as telcos or utilities. The AI data center boom continues and many foreign companies have committed to re-shoring plans into the US.

finformant view

Capital markets have ignored tariffs for some time. The price shock in the goods economy may take them by surprise, and a sell-off in the coming quarter is not unlikely.