Tariff Aftershock: US CPI Hits 2.7% as Trump Targets the Fed

What happened?

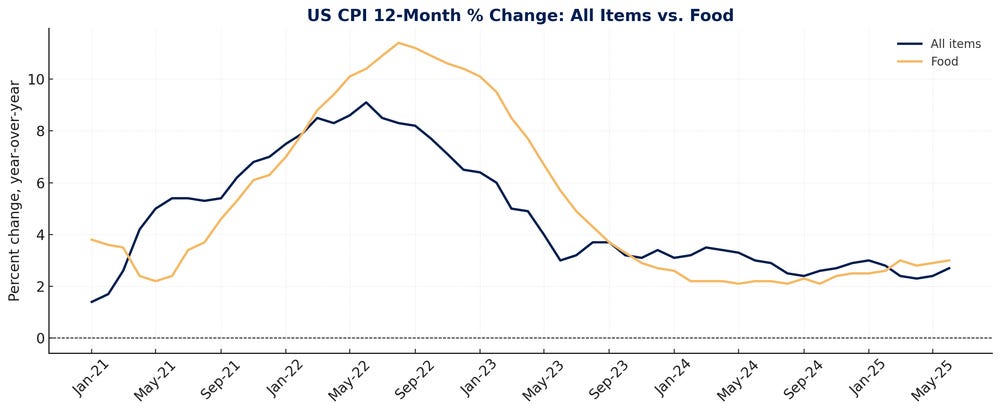

US consumer prices rose 2.7% year over year in June, up from 2.4% in May and above the 2.6% consensus. Tariff-sensitive goods led the increase. President Trump responded on Truth Social: "Consumer Prices LOW — Bring down the Fed Rate, NOW!!!". Futures markets still predict roughly two quarter-point Fed rate cuts by the end of the year, but the odds of a rate cut in July fell below 5% after the report.

Source: US Bureau of Labor Statistics (Not seasonally adjusted)

Why does this matter?

Tariffs are taking a toll: "Today's report showed that tariffs are beginning to bite," said Omair Sharif of Inflation Insights.

Hidden heat: Household furnishings and supplies, a tariff-heavy category, spiked 1% month over month, the sharpest jump since early 2022. Appliances soared 1.9%.

Rates react: Two-year Treasury yields touched 3.9%, nudging the entire yield curve higher and bringing tariffs back onto the radar of equity desks.

Redistribution: Goods-driven inflation acts as a regressive tax, with households absorbing the cost while protected producers enjoy wider margins.

What's the counterpoint?

Core services remain subdued, and used-car prices fell another 0.7%. This hints that firms are still absorbing part of the tariff shock. Continued softness in commodities could keep broader inflation in check and cap yields.

informant view

Tariff-linked "hot spots" could make a 3% headline by Q4 plausible, postponing the first Fed cut to September or later. Likely winners include domestic suppliers shielded from imports and cloud retailers able to pass costs on to consumers.