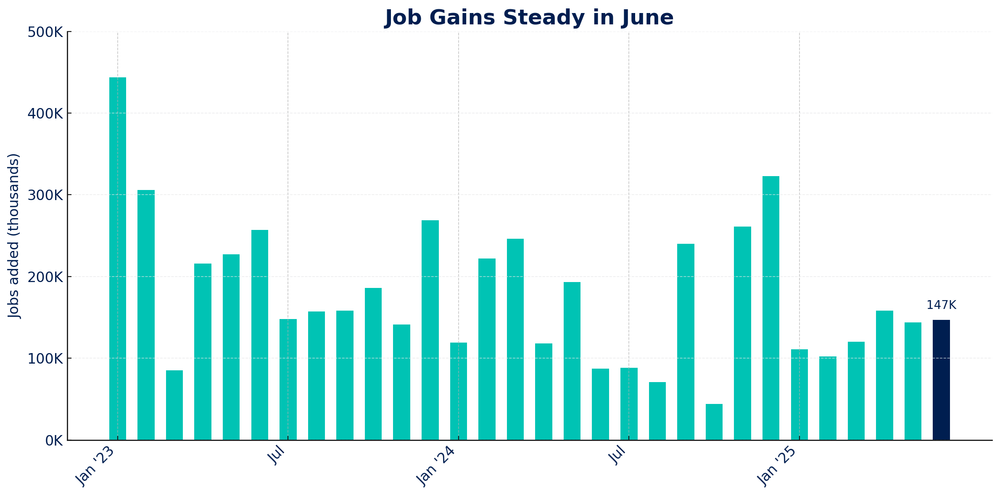

Public-Sector Hiring Masks Labor-Market Softness

What happened?

The June payroll report showed that 147k jobs were added, surpassing the consensus estimate of 110k. However, more than half of the gain came from state and local government hiring. Private payrolls rose by only 74k, marking the weakest increase since October. Average hourly earnings increased 0.2% month over month (~2.5% annualized), the slowest pace in over two years. The unemployment rate unexpectedly slipped from 4.2% to 4.1% as 130k people left the labor force. Meanwhile, continuing jobless claims remain elevated at 1.96 million, the highest since 2021, amid "Deep Tri-State" layoffs.

Source: US Bureau of Labor Statistics

Why does this matter?

Growth quality: Net job creation came from the public sector, while private hiring is losing momentum.

Cooling wages: Sub-3% annualized pay growth signals weaker consumer spending power.

Policy bind: Low headline unemployment makes it harder for the Fed to justify rate cuts, even as underlying demand softens.

Fragile safety net: Rising continuing claims point to longer job searches and growing stress on state benefit systems.

What's the counterpoint?

Some analysts deem the report "good enough": government hiring injects money into households, and lower wages reduce inflationary pressure. Initial claims fell last week, suggesting that layoffs are not widespread. For now, markets view the mix as a "soft landing" signal: stocks closed modestly higher, and the odds of a rate cut in September remain around 30%.

finformant view

Headline strength hides a slowdown in the private sector and slowing wage growth. The Fed has little room to ease soon, yet the real economy looks shaky. A gradual decline rather than a soft landing seems likely.