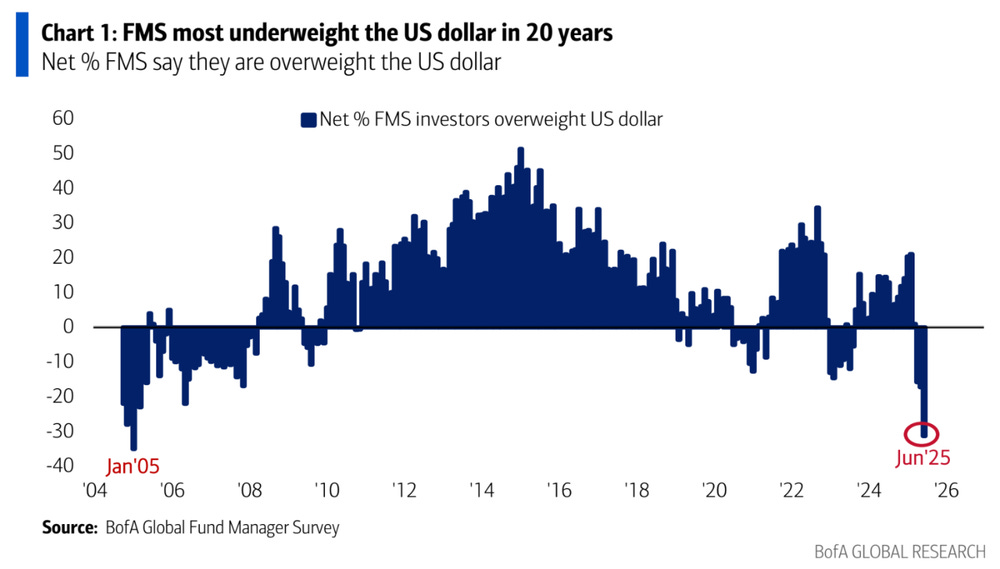

Oversold US Dollar?

What happened?

Sentiment and positioning surveys show the US dollar is currently unloved to a historic degree. There are many reasons for this aversion among investors, as US domestic policies create various red flags for foreign capital, from tariffs that reduce imports into the US, and on the flipside exports of US dollars, as well as capital controls indicated in Section 899 of the "big beautiful bill." Last night, the Senate removed this critical part from the bill, lifting one important headwind for the greenback.

Source: BofA Global Fund Manager Survey

Why does this matter?

Maximum crowding is a contrarian indicator: When the vast majority of investors share the same view, it is usually reflected in the price. The market then often moves in the opposite direction as there is no more marginal actor left, and everyone who is offside needs to close positions, adding fuel to a counter-move.

Fed decision may provide further reason for US strength: At tomorrow's Fed meeting, the market awaits further clues about the direction of monetary policy. With commodities ripping in the wake of the Iran/Israel conflict, it is hard to imagine a dovish outcome (that would support further US dollar weakness).

What's the counterpoint?

Currency moves are notoriously erratic, and even very crowded positioning can at times be overruled by other dynamics. As US economic data continues to weaken, the Fed may prioritize dovish policies to address potential labor market weakness.

finformant view

The extreme crowding in bearish positions, paired with some Greenback-supportive catalysts could cause the US dollar to rally from here. Medium-term trends remain against it, but that is for another day.