High CPI Meets Dovish Fed

What happened?

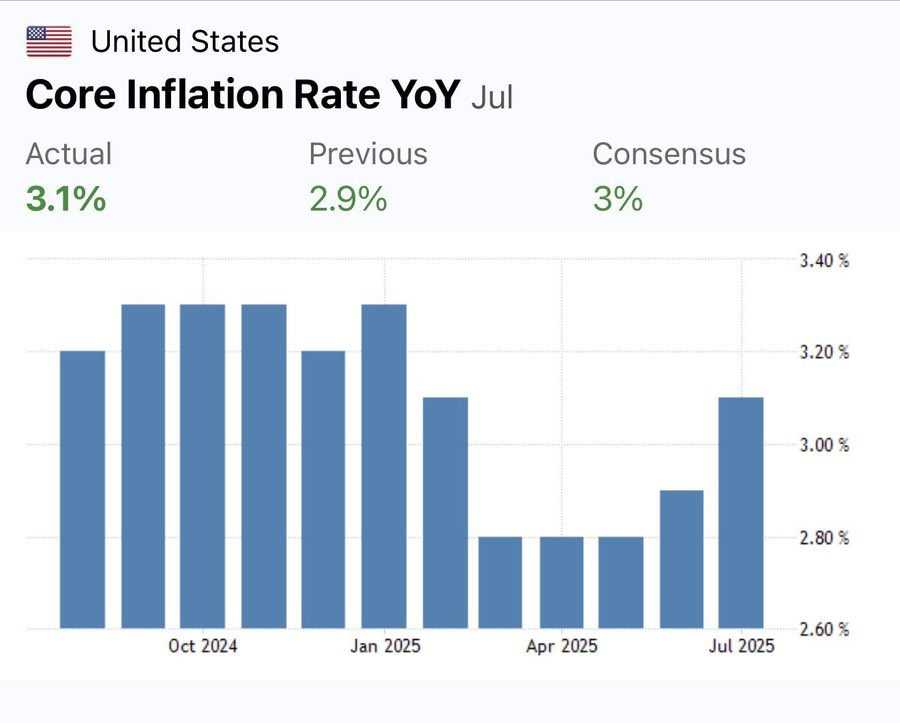

US inflation data was released today, which printed a 3.1% year-on-year and 0.32% month-on-month increase for "Core CPI" which excludes the volatile categories food and energy. Many Fed governors came out over the past weeks arguing for several rate cuts this year; Today's data is within their forecast range permitting this dovish stance, making a September rate cut likely unless Fed Chair Jerome Powell leans against them at next week's Jackson Hole Central Bank symposium.

Why does this matter?

Fed Cutting into Inflation Resurgence: The 32bps month-on-month Core print represents a ~4% annualised reading, which is bound to go up in the coming months as tariff-related price increases are pushed through. Thus, the Fed is likely, literally, cutting into an inflation resurgence.

Stagflation Vibes: While an inflation resurgence seems likely, there are also serious cracks in the labor market and growth is sluggish.

What's the counterpoint?

Fed Chair Jerome Powell could surprise markets next week with a hawkish speech that takes September rate cuts off the table. If he sticks to his previous framing which centered on a currently low unemployment rate and inflation risks, it would be at odds with agree to rate cuts at this stage.

finformant view

With the Fed cutting into an inflation resurgence, bonds across the curve should sell off and high-risk equities such as the Russell 2000 be bid. This may change if Powell's Jackson Hole speech is hawkish.